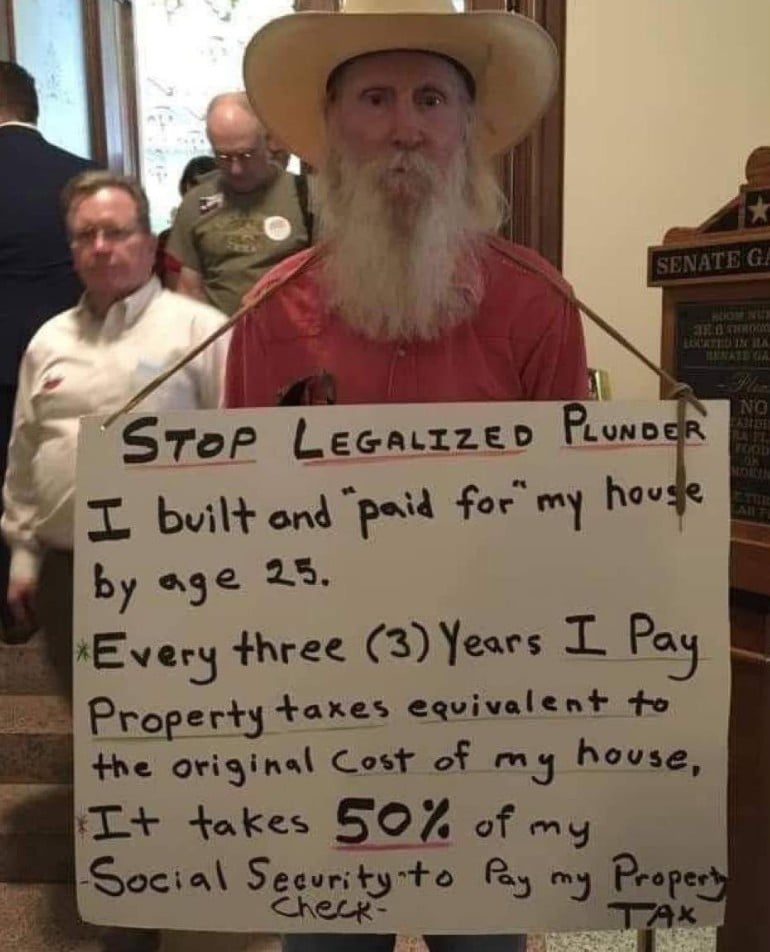

I don’t understand inflation, so as an old landowner I think I shouldn’t have to pay taxes.

Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

Property taxes do hit retired people differently though. Taxing based on what the government says your land is worth instead of your income is absolutely meant to create opportunities for real estate agents and developers at the expense of the people living there.

Taxes based on assets tax those with assets, instead of income taxes which tax those who work.

If old man owns such a valuable piece of land, he deserves to pay his fair share for the public services he used.

It’s like saying you don’t want to pay for schools because you’re not a student.

The fact that schools are funded by the surrounding area is crap and needs to change. He's retired with a social security income. He paid into the system his entire life already. Telling him he must sell and move out because he's not wealthy enough is exactly what we should be working against. It's a system by the wealthy, for the wealthy.

It is kinda fucked up if retired are forced to move out from their house via taxation. Only ones who benefits are real estate companies

For many states property taxes are the majority of funding for public schools. If that's the case for the pictured person, the sign could also read:

"I got my public education for free from age 5-18 funded from others paying property taxes including learning how to read and write to make this sign you're reading. Now that I've received that free public education and benefited from it, I'm not interested in paying for any kids to be educated using my dollars. F you, I got mine."

We could also just pay for education differently.

Yes and. How most of the US funds their school system is super fucked up. Here in Canada, primary education is paid for by the province, and school funding is based on student enrollment numbers. This translates to much more equal levels of education, regardless of how wealthy a given neighborhood may be. I was shocked to find out that schools are paid for by catchment area taxes in must of the states - it makes the history of redlining so obvious when the is literally a "wing side of the tracks".

So he bought a house for 6k 50 years go and now has to pay 2k in property taxes each year. If he was renting that wouldn't cover two months.

Does he also complain that the sales tax on candy bar is more than he used to pay for a candy bar when he first bought his house?

The real problem if that's the scenario is that his social security check is less than $400/month.

And this is why in most civilized countries, progressive income taxes make up the majority of the government budget. Basing taxes on non income/investment related metrics screws over the poor + lower middle class. It's a transfer of wealth from the poor to the rich.

Surely this man would be in favor of a greater and graduated state income tax then, right?

...right?

Interesting. In Texas once you hit 65 they freeze your property taxes and no longer increase it. My parents are only paying $1,800/year on a $250K house. Meanwhile I’m paying $14,000/yr on a $500K house.

Comparing property taxes now in 2025 dollars to unadjusted original cost in 1950 dollars is nonsensical. The two numbers bear no relation nor should they.

The average social security check is $1,978 a month or $23,736 per annum. Half of that is $11,868. Lets suppose he lives in CA where the annual rate for owner occupied is 0.74%. His house would be worth approx 1.6 million dollars. To to be clear he is whining about paying the appropriate and legal tax on his fully owned 1.6M cash hoard. This is a great problem to have.

If its that burdensome he can cash out and even with rent payments for the rest of his life live great even if he has no other savings of any sort.

Looks like about $5800 a month gradually increasing with inflation for at least 25 years.

If he has another $400,000 which seems super likely since I don't think he's actually living in his 1.6M house on $12,000 a year it could be more than 7500 a month.

If we add a little realism and only include another 15 years he could probably actually withdraw about 11,000 a month.

https://www.kiplinger.com/retirement/social-security/average-monthly-social-security-check https://www.tax-rates.org/taxtables/property-tax-by-state

I think it's the moral issue of having to cash out your own property to afford to live in something you built and already own

While I do think there should be some relief for some people as far as property taxes are concerned... living in a town or city gives a person access to many local government subsided services. Firefighters, and ambulances are some simple ones that everyone uses. Roads as well. And the cost of that does increase over time. Basing a person's contributions to paying for that based on the value of thier property is just easier for local governments, and more stable. But it doesn't really corelate with the use of those services. Nor with income or ability to pay.

Life necessities really shouldn't be taxed at most levels. Food, shelter, water, heat, medical care. Most already aren't. But housing still is. Investment properties should be taxed of course, but an average primary residence really shouldn't be.

Is this guy paid by some rich guys wanting to abolish property taxes?

I see both arguments for this as valid. I get that you wanna stay and live your entire life in the place you owned forever. The reality is taxes are needed and will increase forever, which are important to keeping your state functioning (as long as the people in charge are doing a good job and actually using the funds wisely). I wonder what state they are from because I know property tax can be wildly different depending upon that. I'm sure they don't want to, but there are like 6 states that currently offer no property tax to seniors over 65 and 10 that offer exemptions based on income and age. At the same time it is good to see them complain because maybe they can try to sway the state to also offer the no property tax benefit to seniors as well. Still if he is hurting that much, then it's probably easier to sell the place and move to another place that will allow him to be better off with less worrying. It's a valid option even if he doesn't agree with it.

his point is that his income should have increased to reflect inflation, since his taxes did. it's actually obscene that half his check goes to property tax on land he's had forever, and people are talking down about him for it.

They dangle the carrot of "home ownership" as if anyone ever owns a home that can be taken away for not paying taxes.

Property tax is the big thing that forces people to engage with capitalism against their will.

Without property tax, you could live off-grid for eternity. But with property tax, you always have to earn money, and the people that control that money therefore control you.

Property taxes go towards education. More right-wing bullshit attacking schools.

But this is a bad idea.

Areas with high property value have higher quality schooling. Area with low property value have lower quality schooling. The rich stay rich. The poor stay poor.

Maybe education money shouldn't come from property taxes. Maybe corporations should pay for the education they require their workers to have visa corporate taxes