How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

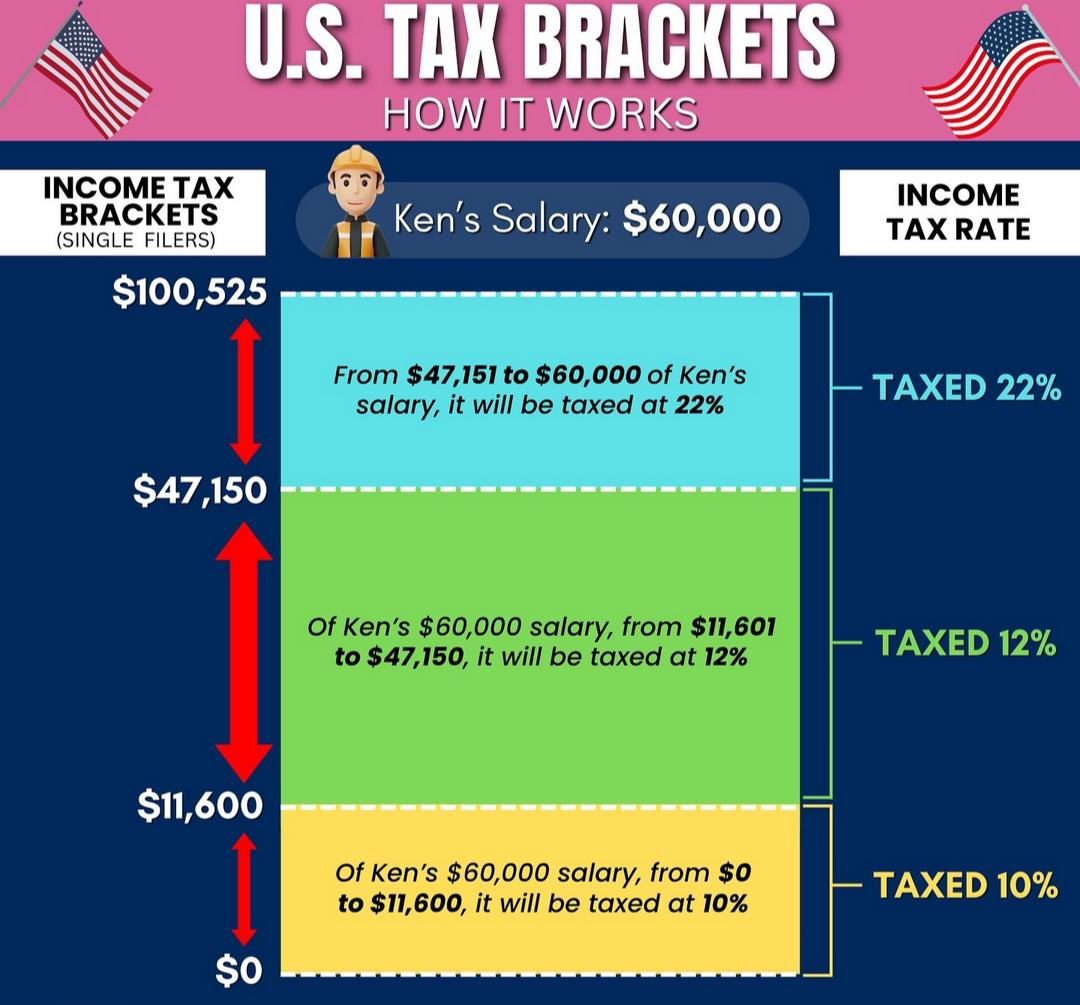

Tell me you don’t know how income taxes work without telling me you don’t know how income taxes work.

My question is who does their taxes then?

A lot of people don't know anything about taxes and have their tax return done by an accountant, even if their situation is extremely simple (works one job, no taxable investments or capital gains, no investment properties, no foreign taxes paid).

This is the problem. My partner doesn’t want to work OT because he thinks it will cost him more in taxes. I explain why that’s not exactly true, but I can tell he’s not interested. Financial Literacy in the US is abysmal.

This is not a US specific issue, tbh. I've heard this weird belief repeated by all sorts of people.

it is a misinformation many people in power wants to keep because it lets republicans sell their policies to not tax the rich and bosses to not raise their employee's salaries.

You’re absolutely right. I cant speak for anyone else, as I don’t live there but I highly doubt the US is an exception.

Rather than being mad at each other, I want to make sure we hold the right people accountable! Governments, corporations, billionaires etc.

It’s a form of oppression.

Your partner is a moron who doesn't understand relatively simple math.

"you can't make less money by making more money"

Unless you're poor enough to be on welfare. The Welfare Cliff is awful.

This can also apply to student loans when one person makes a lot more than the other.

I've had jobs (more than one), where working OT would result in my paycheck take home pay being less than if I had not worked the extra hours. And that's because it moved me into the next bracket, and more taxes were taken out. So why waste my time working OT?

Oddly enough it kinda does. OT can make you pay out more taxes on that one check since withholdings are calculated by check. Basically the government/payroll system thinks you're going to be making that every week so more taxes will be taken out.

In reality this only effects the size of your tax bill or return at the end of the year.

That's what people see and exactly why they think they got kicked up a whole tax bracket.

lol i wonder how much that is just guessing. they just coin flipped it

For someone outside the American tax system, can anyone put the difference in approximate numbers?

In exact numbers, 5 cents.

That one dollar in the 33% bracket has .33 in taxes instead of .28. So their obligation goes up .05 per every dollar in the 33% tax bracket.

Your local tax system probably works the same.

It boggles my mind how many people who have had to pay taxes for decades even, don't understand how tax brackets work.

The only time you'll get screwed on making more is if you were getting some sort of socialized assistance and you make a dollar over the cut off for aid.

Yeah, the Welfare Cliff is the only place where this happens and it's unconscionable.

It is kind of by design to keep people from trying to get ahead at all

And they'll also refuse to believe you when you try to explain it to them

I used to be a supervisor at a psych hospital and had to regularly explain this to staff who were refusing overtime. They wanted to do it, sometimes desperately so because they needed the money, but they were utterly convinced that once they crossed 40 or 45k or whatever they would be taxed higher and make it all pointless. I felt like some just didn’t want to do ot, which was fine, but some legit keep meticulous records of their earnings to ensure they wouldn’t go over the line. I swore to them it didn’t work this way but they never believed me

Seen the same bullshit when I worked retail. Nothing will convince them.

It's easier to trick someone than it is to convince them they're wrong.

Should print out a poster infographic explaining progressive taxation and put it up on the wall in the break room

Yeah I am pretty sure they wouldn't understand this either

This infographic is kinda bad and would not convince someone who doesn't know how it works at all

Would have to be mandated by workplace regulations, no company is going to voluntarily educate their employees that more money has no downside.

I'll also say this doesn't help, it strangely avoids the actual numbers. It should state explicitly that his total taxes would be $1,600+$4,266+$2,827=$8692, and not $13200. Needs to include the scenarios specific results and contrasted with what the viewer would have assumed otherwise.

If you ever wanted proof that a population that doesn't understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you'd more likely support higher tax rates for the rich.