this post was submitted on 02 Dec 2024

984 points (98.6% liked)

memes

10700 readers

2345 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

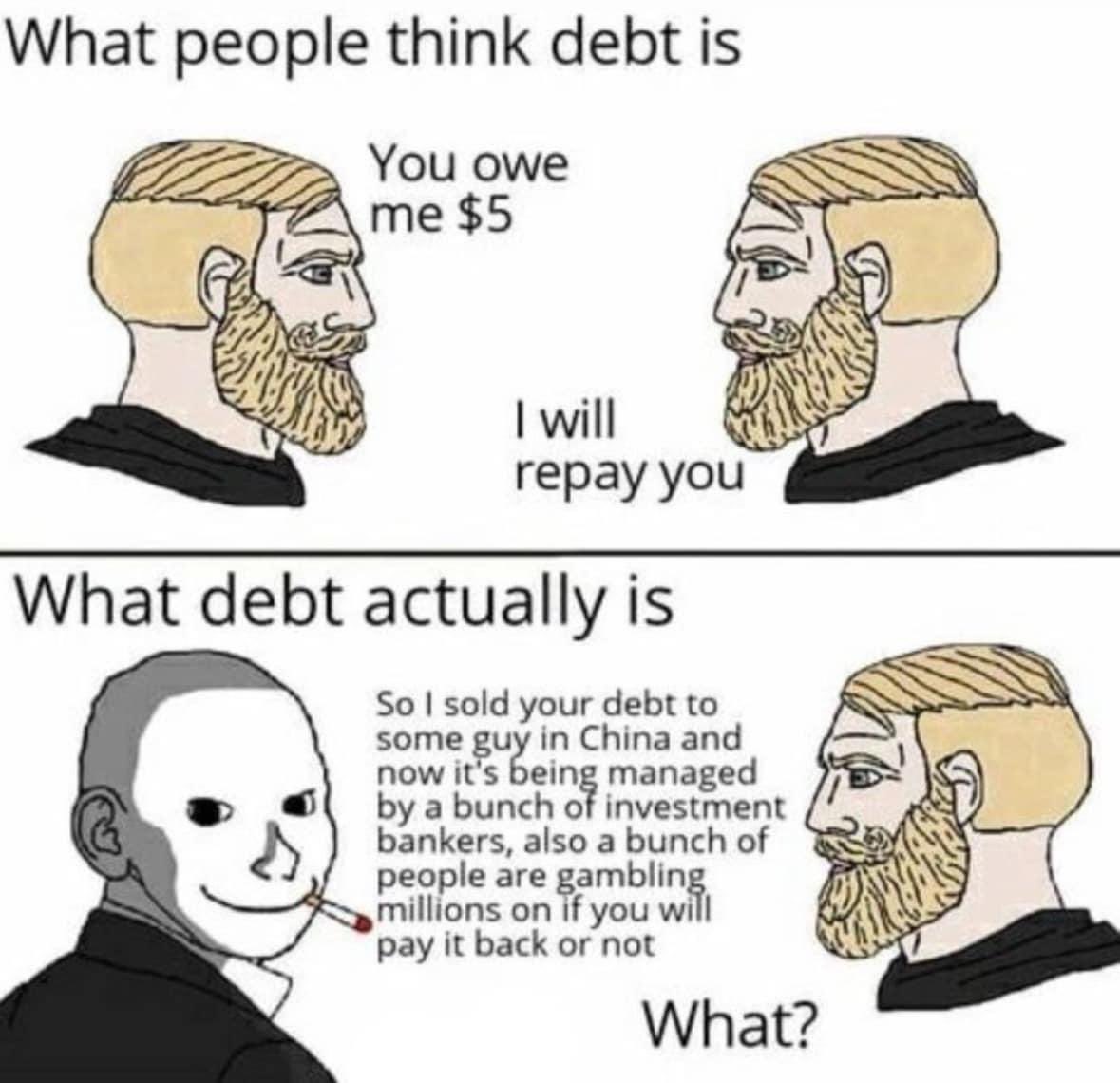

If you get into "The Big Short", what you'll discover is that this was effectively what the insurance on the mortgages accomplished. Buying insurance is a losing gambit (also called a hedge) wherein the underlying asset (the policy) loses money over time with the anticipation of a potential windfall at some unspecified event in the future.

What Mark Baum and Michael Burry had done was to effectively buy these insurance plans from the banks themselves, diverting the windfall from a crash into their own pockets. The banks shouldn't have been auctioning off their insurance (for the same reason you shouldn't try to sell your fire insurance claims on your house to your neighbor in an effort to turn a profit). But the investment was considered crazy precisely because these insurance plans only ever existed as a fig leaf for regulators and investors (even if we fail, we can't fail, because we have insurance!) Nobody asked who was going to pay out this insurance or who was going to collect.