this post was submitted on 02 Dec 2024

984 points (98.6% liked)

memes

10700 readers

2345 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

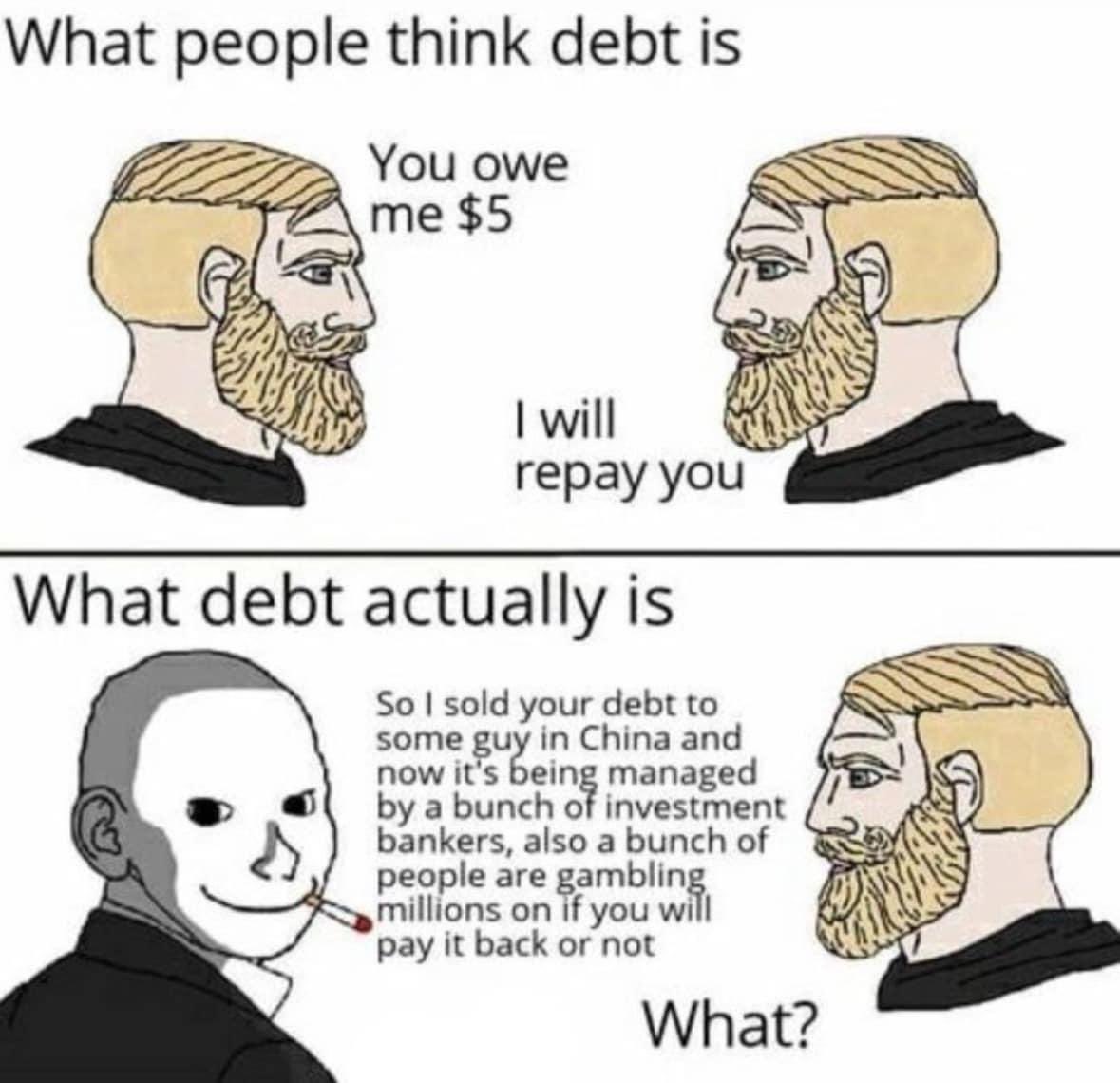

Sure, I agree. But in the same technicallity; purchasing or selling anything is technically gambling, there's a chance that it will devalue or increase in value over time. You could've bought (or sold) earlier (or later). (Electricity market, again, being an interesting exception, as the product is destroyed as soon as it's created. One could say the true value is never discovered, as it's only sold as futures).

The fundamental problem that lead to the '08 crisis was incorrectly priced mortgages, and risk of repayment/devaluation. Even if the morgages were held by the original issuers, the same outcome would've occured.

It wasn't the derivative market that was the problem.

An example of a derivative, that I can't think of any reason for existing, other than increasing risk, are leveraged ETPs. I'd call those as close to pure gambling of any derivatives I know of.

Those mortgages were priced incorrectly because the derivatives market inflated their value. There were other factors that contributed certainly. The credit rating agencies certainly played a critical role, but they were incentivized to inflate their rating because of the MBS market.

The regulation of these markets was also to blame, and that's a whole other can of beans, but again this was due mostly to the revolving door between the regulatory agencies and the investment funds that profit from lax regulation of the derivatives market.